Last Updated on 05/11/2023

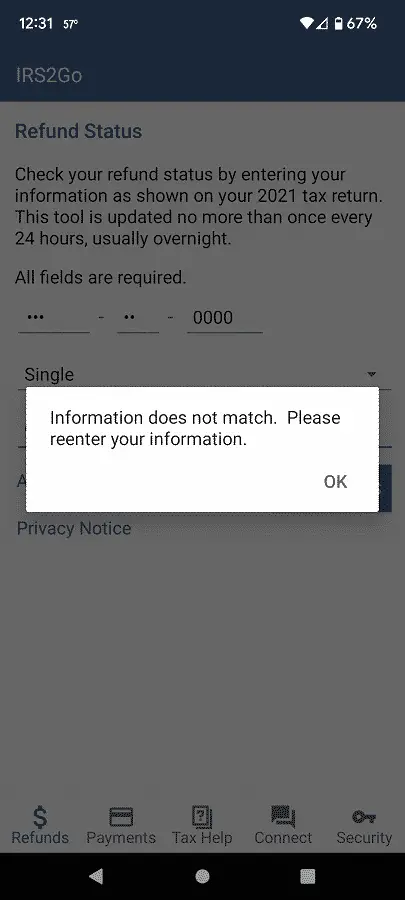

When trying to check your refund status from within the IRS2Go mobile app, you can get following messages:

“Refund status error”

“Information does not match. Please reenter your information.”

To see how you can potentially fix these issues, you can take a look at this troubleshooting guide at Overly Technical.

1. The first step we recommend taking is to make sure that you are checking your refund status at the right time.

The “Where’s My Refund?” service will go offline every Monday at 12:00 am EST to 3:00 am EST.

Furthermore, the entire IRS server may occasionally go down for maintenance on Sunday from 1:00 am EST to 7:00 am EST.

The Refund Trace feature also won’t be available in the following times:

- Sunday: 12:00 am EST to 7:00 pm EST

- Monday: 12:00 am EST to 6:00 am EST

- Tuesday: 3:30 am EST to 6:00 am EST

- Wednesday: 3:30 am EST to 6:00 am EST

- Thursday: 3:30 am EST to 6:00 am EST

- Friday: 3:30 am EST to 6:00 am EST and then 9:00 pm EST to 12:00 am EST

Of course, the IRS servers can also get too overwhelmed with requests at any time, especially during the tax filing season.

2. Furthermore, you should make sure you are entering your information correctly.

If you are filing your taxes jointly, you can use your Social Security Number or the Social Security Number of your spouse.

You should also make sure that you select the correct filing status. You can choose between the following:

- Single

- Married-Filing Joint Return

- Married-Filing Separate Return

- Head of Household

- Qualifying Widow(er)

Finally, you need to enter your refund amount. You can find this amount in the following places on your tax form:

- Line 35a on Form 1040

- Line 35a on Form 1040NR

- Line 14a on Form 1040PR

- Line 14a on Form 1040SS

3. You can also try closing and then re-opening the IRS2Go app.

If you have any other apps opened, we suggest that you should also close the other apps before opening IRS2Go again since they may be causing conflicts with the IRS mobile application.

4. You can try refreshing the internet connection as well.

In order to do so, turn off your mobile network and/or Wi-Fi connection and then turn it back on again.

5. Moreover, we recommend restarting your smartphone or mobile device so that you can free up additional resources that may have been taking up a lot of processing power on your smartphone or mobile device.

6. You should also make sure that the IRS2Go mobile app is updated.

You can download the latest version on the Google Play Store if you are using an Android device or the Apple App Store if you are using an iOS device.

7. It is a great idea to update the firmware of your smartphone or mobile device as well if you haven’t done so alread.

8. If you are still getting “refund status error” message and/or “information doesn’t match” message, then the next step you can take is to delete the IRS2Go app data.

To do so with the Google Pixel 6 or Google Pixel 6 Pro running on the Android 12 operating system, for example, you can take the following steps:

- To start off this process, open the Settings app.

- After getting to the first page of the Settings menu, select Apps.

- Once you arrive in the Apps menu, select the “See all apps” option.

- You should now be in the “All apps” menu. This is where you need to select IRS2Go to continue.

- From the “App info” menu of the IRS2Go mobile app, select the “Storage & cache” option.

- After arriving at the Storage menu of IRS2Go, you can select the “Clear cache” option to delete the temporary files of the app or the “Clear storage” option to delete all user data from the app.

9. You can also try deleting the IRS2Go app from your smartphone or mobile device.

Afterwards, you can re-download the official IRS application again on the Google Play Store on Android or Apple App Store on iOS.

10. One last potential fix for the “refund status error” and “information doesn’t match” issues is to try to use the IRS website on a mobile web browser or on a browser via another device.

If the official IRS website is also down, then you may have to call IRS to get help.